Following the Road Less Traveled in Search of Undervalued Opportunities

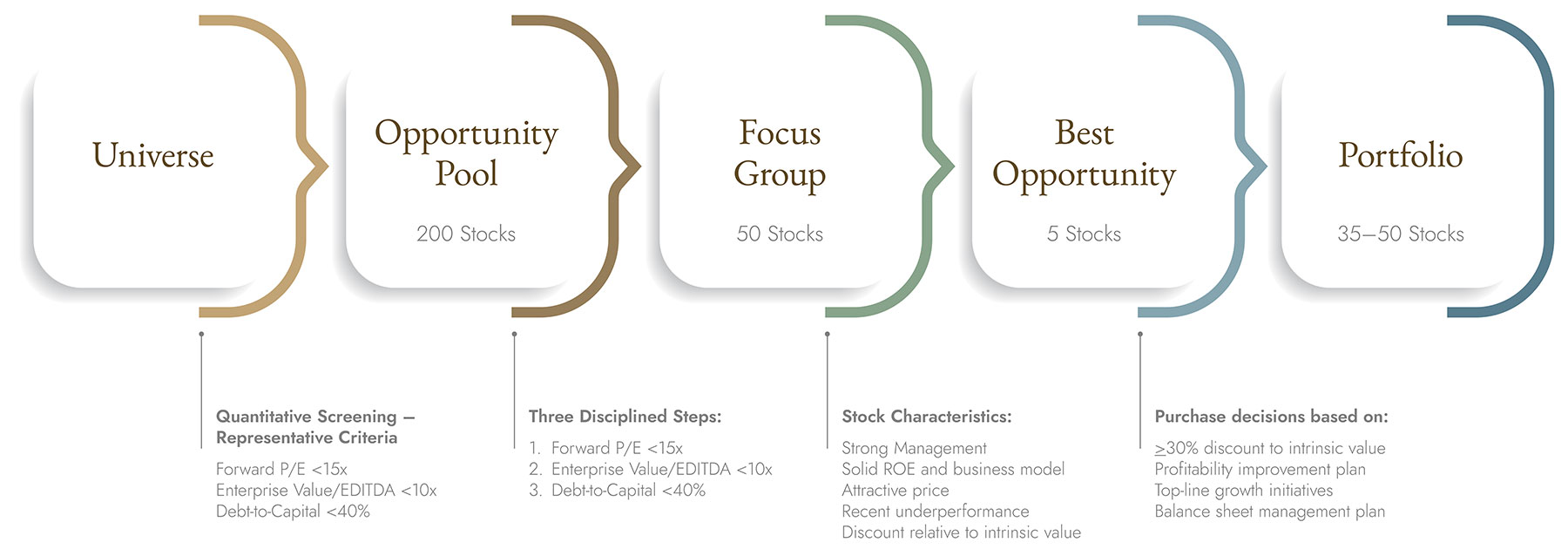

Our investment process is disciplined, focused, and designed to help us identify investment ideas before they are widely recognized in the marketplace.

Through fundamental analysis, we look for opportunities to invest in quality businesses trading significantly below their intrinsic value. These opportunities typically emerge when companies experience subpar operational performance or endure prolonged industry underperformance. We believe the most promising scenarios are when these companies show potential for sustainable improvement.

Step 1: Universe

Our universe of investment ideas is generated from the team’s deep knowledge of specific companies and through a proprietary screening process. Ideas are then evaluated on time-proven valuation criteria.

Step 2: Opportunity Pool

We look for companies with a combination of the following characteristics:

- Capable management

- Enduring business franchises

- High or improving returns on invested capital

- Solid financials

- Trading at a discount relative to intrinsic value

To maintain our in-depth understanding of the companies in which we invest, we are in regular contact with the management teams.

Step 3: Portfolio Construction

Portfolios are constructed on a stock-by-stock basis, with careful consideration of the return potential for each individual security. As a boutique firm investing in a relatively small number of companies at any one time, we are able to opportunistically capture alpha through stock selection. We employ deliberate sector and industry diversification as a strategic risk management tool.

Step 4: Continuous Review

Our process is disciplined, yet dynamic. We regularly review and modify our portfolios to ensure they maintain a roster of quality investments with attractive valuations.

“I’m proud of the intrinsic value discipline we’ve built. We are high conviction investors with the best-ideas approach.”

– Wendell E. Mackey, Co-Founder, Co-Chief Executive Officer and Chief Investment Officer